Financial Crime Operations Analyst

Enhance Shieldpay's Financial Crime framework in the first line of defence.

We usually respond within two weeks

The opportunity

As a Financial Crime Operations Analyst you'll provide key operational support by onboarding and dealing with the management of complex financial crime cases. You will develop and refine of operational procedures, supporting materials, and tracking the progress of enhancements to the financial crime framework. The role will collaborate closely with the second-line Compliance team to ensure that all processes and documentation effectively address financial crime risks.

What you’ll be doing

- KYC and Quality Assurance: Perform KYC on various client types and risks, including enhanced due diligence and complex ownership structures. Conduct Quality Checks on KYC files completed by team members.

- Risk Assessment: Collaborate with the Compliance team to enhance the organisation-wide Financial Crime Risk Assessment.

- Control Implementation: Work closely with the Head of Financial Crime to implement necessary controls identified through the Risk Assessment.

- Procedure Development: Author and refine procedures related to Financial Crime Operations activities.

- Risk Mitigation: Ensure that procedures effectively mitigate financial crime risks and work with the Compliance team to obtain necessary approvals.

- Progress Reporting: Track and report to senior management and the board on enhancements to the Financial Crime framework.

- Procedure Maintenance: Maintain up-to-date procedures and manage the ongoing review of first-line procedures and controls.

- Technology Integration: Collaborate with RegTech providers to identify and implement solutions that enhance first-line controls and product offerings.

- System Enhancement: Work with IT to improve financial crime operations systems by drafting requirements and collaborating on IT capability refinement.

- KYC and Quality Assurance: Perform KYC on various client types and risks, including enhanced due diligence and complex ownership structures. Conduct Quality Checks on KYC files completed by team members

What we're looking for in you

- Strong attention to detail!

- Deep understand of KYC/Compliance/AML standards at UK regulated financial services company.

- Can effectively understand financial crime risks posed to financial services companies and design and implement operational procedures to mitigate these risks.

- Knowledge and understanding of payment schemes and regulatory regimes.

- Demonstrated experience of due diligence in onboarding/KYC refresh of financial services and products.

- Knowledge of multiple complex client types (i.e., Corporates, Non-Banking Financial

- Institutions, Funds, Non-Operating/Asset Holding Companies/SPVs, Organizations, Publicly Traded Companies, Trusts)

- Strong written and oral communication skills with experience of conflict resolution and ability to influence internal and external stakeholders

- Proactive and flexible approach to personal workload and wider team targets

- Ability to work under pressure and to fixed deadlines

-

Effective at managing time appropriately and organising workload for maximum

productivity. - Logical, structured approach to planning, problem solving and decision-making

Our promise

Shieldpay is an equal opportunities employer. For Shieldpay building a fair and transparent workforce begins with the recruitment process that does not discriminate on the grounds of gender, sexual orientation, marital or civil partner status, pregnancy or maternity, gender reassignment, race, colour, nationality, ethnic or national origin, religion or belief, disability or age.

At Shieldpay we will consider requests for flexible working on hiring. For most roles, the following types of flexibility are usually possible: flexible hours, Hybrid working (an element of working from home), compressed hours. Many of our staff work flexibly in many different ways.

- Team

- Operations

- Locations

- London

- Remote status

- Hybrid Remote

- Employment type

- Full-time

- Employment level

- First /Mid-Level Officials

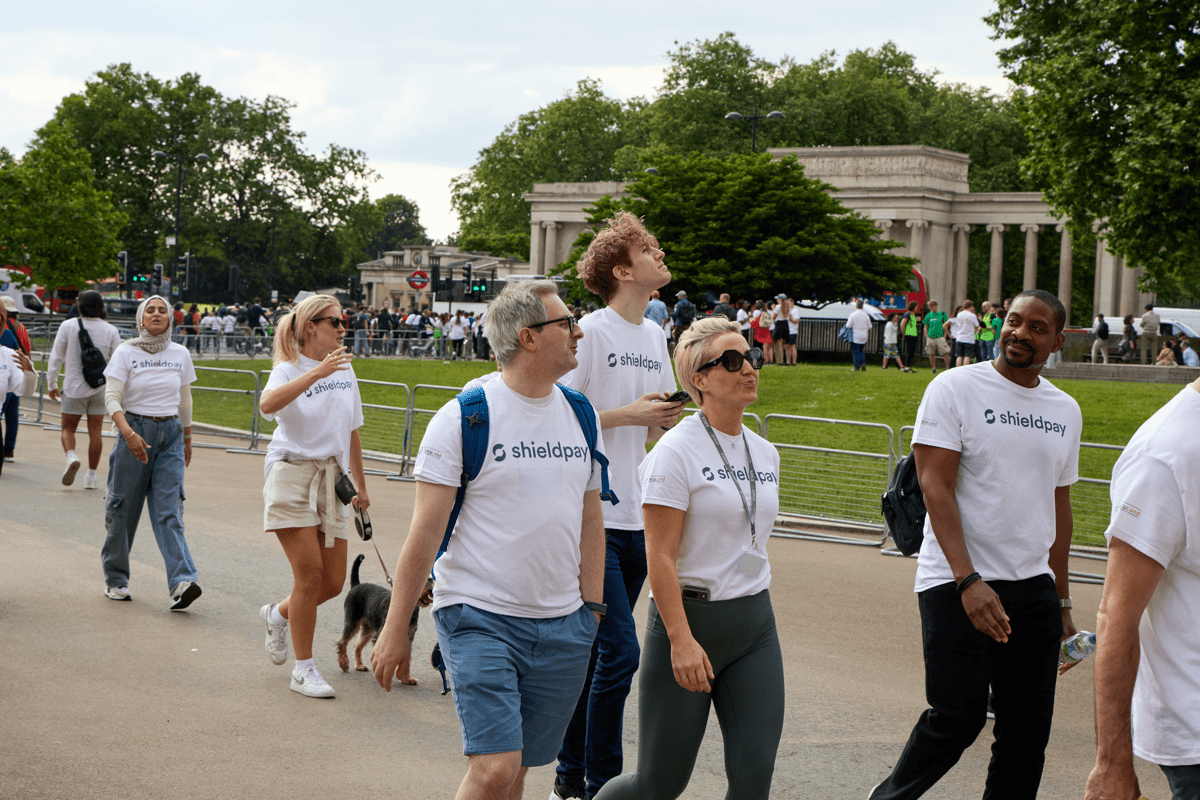

Workplace & culture

Our team is filled with ambitious, curious and entrepreneurial people. We hire and nurture inquisitive, creative minds looking to flourish in a supportive and collaborative environment, recognised by being placed within the top 100 startups to work for in 2022 by Tempo and Flexa certified in 2023

We don’t like old fashioned corporate hierarchy. Instead we like to empower our people to make a change and be autonomous in their role with all the support you need with the other teams around you.

About Shieldpay

Shieldpay Limited: Regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (Reference number 770210) as an authorised payments institution. Shieldpay is a company providing simple and transparent payment solutions across the legal, financial, and professional services industries. The firm offers Third-Party Managed Accounts, Escrow facilities and payment agent services.

Shieldpay Trust Services Limited: Registered with HMRC as a trust service provider (Reference XPML00000158706) and provides the services as a corporate trustee to the beneficiaries of the trust, established by deed, in connection with escrow transactions.

Registered Address for our Group Companies is 3rd Floor, 1 Ashley Road, Altrincham, Cheshire, WA14 2DT.

Financial Crime Operations Analyst

Enhance Shieldpay's Financial Crime framework in the first line of defence.

Loading application form

Already working at Shieldpay?

Let’s recruit together and find your next colleague.